With European companies scrambling to adjust to America’s unilateral withdrawal from the Iran nuclear deal, some major businesses have already declared that they are ready to exit Iran if they do not secure sanctions waivers from the US. European leaders for their part have harshly criticised Trump and reaffirmed their support and intention to uphold the deal.

Despite the Trump administration’s assertions that sanctions will pressure Iran to renew negotiations for a ‘better’ nuclear deal, his decision sends very different signals to the nuclear deal’s other principal signatories. For some in Iran, Trump’s move only strengthens a view that negotiations with the US are ultimately futile. For the Europeans, the eventual re-imposition of sanctions signals that Washington is happy to jeopardise European contracts in a market that has in any case largely remained off limits for American companies. Even the headline multi-billion dollar Boeing deal to sell aircraft to Iranian carriers had barely started being implemented, with Boeing’s CEO citing prior reservations and downplaying lost opportunities in Iran.

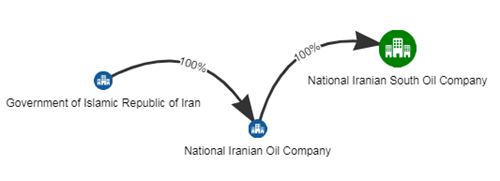

Nevertheless, Trump’s May 8 announcement has not deterred everybody; on May 16, Pergas International Consortium, composed of several international (including EU and Americas-based) companies, signed a 10-year heads of agreement with National Iranian South Oil Company (NISOC). The international consortium’s new partner is a subsidiary of the government-owned National Iranian Oil Company, which until the implementation of the nuclear deal was designated on OFAC’s SDN list for secondary sanctions. Although NISOC itself was not designated on the SDN list, the current outlook of the Trump administration’s policies suggests that it could be targeted along with its mother company. The deal’s survival likely depends on whether it will be supported in London, where Pergas is based.

The dust is still settling on a move by the US which has implications far beyond Iran, raising questions around how much the EU can assert itself on the global stage, especially when you consider the wider context of current discussions on US steel tariffs and TTIP free trade negotiations. Although European leaders may chiefly talk about the importance of the nuclear deal to regional security and stability, the prospect of folding to Trump’s unilateralism and enabling Chinese, Russian and other non-EU companies to fill empty slots in lucrative contracts – a future outcome envisioned at the top political level in Iran – would be galling. As such, EU members and institutions are studying precedents for circumventing American sanctions regimes – notably the case of Cuba in the mid-1990s. Regardless, such protective measures would rely on significant political will and, more importantly, the ability to convince Iran that the EU will not discard the deal as easily as Trump did.

What next?

With Donald Trump having decided to quit the Iran nuclear deal, the suspended US nuclear-related sanctions will come back into full force. This will occur after a so-called ‘wind-down period’ with two deadlines: August 6 and November 4, 2018.

How will this come about? US Secretary of the Treasury Steven Mnuchin explained that after the three-month deadline in August sanctions would kick in ‘for most things’ – specified by OFAC, the US agency administering sanctions, as, inter alia, blocking the Iranian government purchasing US dollars, revoking a number of trading licenses and sanctioning trade with gold, metals and the automotive sector. According to Mnuchin, the six-month November deadline concerns ‘energy-related and miscellaneous items… we wanted to be careful on the energy markets that we had an orderly transition away from Iranian oil.’ Thus, by November 4, the US will reimpose the remaining pre-nuclear deal sanctions, including on the energy, petroleum and petrochemical sectors, port and shipping operators, and insurance and reinsurance services. Also in November, those persons and entities removed from OFAC’s Specially Designated Nationals and Blocked Persons (SDN) list in 2016 under the nuclear deal will be re-designated on the SDN list. These designations target Iranian government-owned entities and financial institutions (like banks).