How to avoid common mistakes when expanding in the Middle East

Read moreSource of wealth indicators in Africa and the wider Middle East

One of the areas where compliance teams can struggle is to establish and verify the source of wealth of an individual. Even FATF regulations and EU AML directives acknowledge the difficulty of the exercise, calling for a risk-based approach and a balance between publicly-available information and voluntary disclosure by the client.1 But for those sectors that handle high-value transactions, such as wealth management, casinos and exchange houses, it becomes an issue of commercial risk as well as compliance.

Identifying the source of wealth of an individual from Africa or the Middle East is particularly challenging, and unless your client happens to feature in the Forbes Rich List the chances are that a Google search or media sweep is unlikely to yield much insight. Factors that contribute to this issue include the prevalence of inherited wealth in the region, a lack of publicly accessible records, and a cultural reticence when it comes to disclosing personal wealth.

In our experience at Diligencia, a picture can be built of an individual’s source of wealth via a number of indicators:

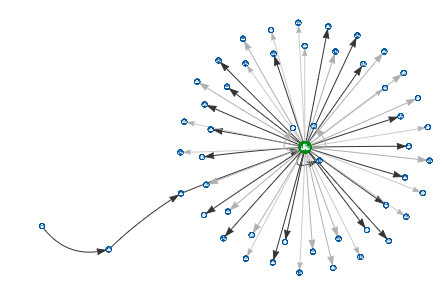

Corporate interests – a key public domain indicator is an individual’s shareholdings, and in the MEA region corporate holdings are seen as an important way of both generating and managing wealth between generations. By way of illustration our most connected individual on ClarifiedBy.com has over 1,000 shareholdings across the region. If some of those companies are publicly listed, then the value is easy to calculate, otherwise some assumptions need to be made around the size of each private company

ClarifedBy.com Network Diagrams

An example of an individual's network diagram on ClarifiedBy.com

Family relationships – wealth in the Middle East and North Africa tends to stay in the family so if you have visibility of an individual’s family tree it can provide an important clue to his or her source of wealth. The most obvious example is an individual who belongs to or marries into a ruling / royal family

Patronage – this is less clear-cut and overlaps into checking for PEP status, but if an individual is known to have held a role in a diwan or ruler’s court, then it is very likely that this level of trust and patronage will have come with a large financial reward

Other means of testing source of wealth are out there, most notably ownership of property and real estate. However, whilst it is possible to retrieve land records in many MEA jurisdictions (and this is a service offered by Diligencia) it can be tricky to identify individual assets, and it is unlikely to be part of a quick and efficient process that is typically expected of compliance teams.

So, if a new client walks through the door and you are able to identify that he is the son of a chief adviser to a royal court, is a director of a family business and holds a stake in a large Gulf-based financial institution, then your source of wealth question may well be answered.