Why understanding cross-border ownership is critical for KYB compliance

Read moreThe case for transparency and open data

Following my recent participation in a panel session at the annual Corporate Registers Forum (CRF) in Tunis, I wanted to take a moment to reflect on why transparency and open data are vital tools in combating corruption, tax evasion, and money laundering — and how registries and data providers like Diligencia play a foundational role in this ecosystem.

Table of contents

Why transparency and open data matter

The positive consequences of transparency

The unintended consequences

The central role of registries

Challenges we face

The path forward: Solutions that work

Why data accuracy still matters

Looking ahead

Why transparency and open data matter

Having access to accurate, open, and standardised information allows us to:

- Truly know our counterparty

- Gain clarity on individuals and entities, removing ambiguity

- Identify ultimate beneficial owners and controllers

- Standardise processes across data sources and jurisdictions

These capabilities are essential for due diligence, compliance, and risk management in today’s interconnected world.

The positive consequences of transparency

When transparency and open data are embraced, the benefits ripple across the financial and business landscape in the following ways:

- Efficiency gains – saving time and money

- A single, consolidated view of client, control, ownership structures and risk

- Reduction in financial crime, corruption, and money laundering

- Improved compliance and a reduction in regulatory fines

- Enhanced business confidence and greater trust between parties

- Increased inward investment driven by transparency and accountability

The unintended consequences

However, with openness can come unintended consequences. For example, while transparency empowers accountability, it can also raise privacy and data protection concerns, or expose individuals to risk in sensitive jurisdictions. Balancing these competing priorities — openness and privacy — remains an ongoing global challenge.

The central role of registries

Registries sit at the heart of transparency. They are the custodians of foundational information that underpins business confidence and financial integrity. Yet, registries themselves face challenges that impact how data can be accessed, used and trusted.

Challenges we face

At Diligencia, and among our clients, we continue to navigate several key challenges:

- Lack of standardisation across sources and registries (in data fields, formats, and definitions)

- Regulatory differences, where jurisdictions vary in their reporting requirements

- Local norms, languages and practices, influencing how information is captured and shared

- Absence of a single, unified source of ownership data (such as UBO registries)

- Timeliness, as registry updates often lag behind real-world corporate changes

The path forward: Solutions that work

The good news is that practical and scalable solutions — both existing and emerging — can help address these issues:

- Adoption of globally accepted standards (e.g. ISO frameworks)

- Use of unique identifiers such as LEIs (Legal Entity Identifiers) and CRNs (Company Registration Numbers)

- Collaboration with trusted data vendors and providers

- API and online accessibility for greater efficiency

- Real-time reporting to reflect current information

- Identity verification mechanisms for individuals

Why data accuracy still matters

Even with open data, registry information is only as good as its inputs. To state the obvious, seemingly legal and correctly incorporated entities can be used as a front for illegal activity, and the ownership structures can be a proxy for the real controllers.

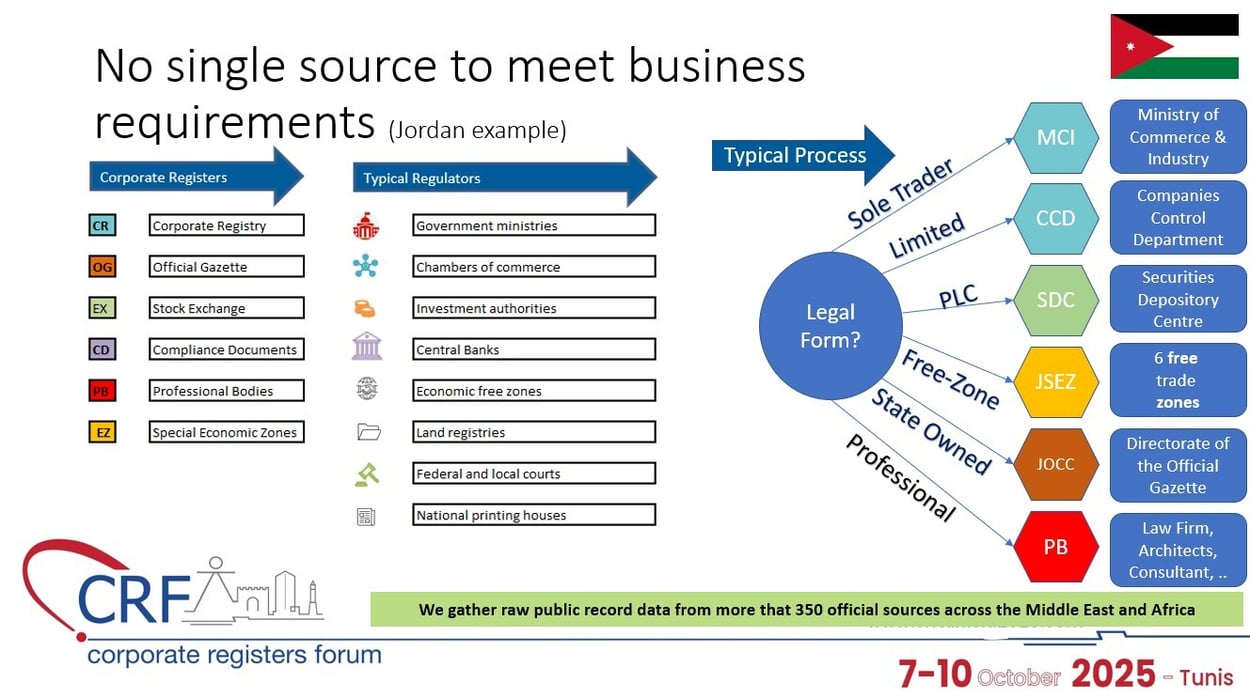

At Diligencia we provide layers of context and validation around the information we provide to our customers by using multiple sources within each jurisdiction we cover — not just from the corporate registries (see example below for Jordan). This enables us to build relevant and actionable intelligence which can offer a truly comprehensive picture of a company and/or its associated persons.

Looking ahead

We live in an increasingly connected world, where cross-border information is critical for due diligence, compliance, investigations and investment decisions. Encouragingly, many registries are now collaborating more closely, sharing best practices, and recognising the importance of openness, and this was apparent in the CRF conference in Tunisia last month.

I’m delighted to be part of this ongoing conversation on how the industry can enhance transparency. At Diligencia, we’ll continue to weave together the threads of information we gather across the Middle East and Africa — delivering clear, accurate, and easy-to-digest entity profiles that help our clients make better-informed decisions, and facilitate openness and good business practice in the jurisdictions we serve.

Diligencia helps customers from around the world to find essential information on organisations registered in Africa and the wider Middle East, drawing on primary sources that are otherwise hard to find. Using our curated data, we enable our clients to effectively manage their compliance obligations, allowing them to continuously monitor their suppliers and counterparty risks in the MEA region.